child tax credit payment schedule for october

As part of the. The payment for the.

600 in December 2020January 2021.

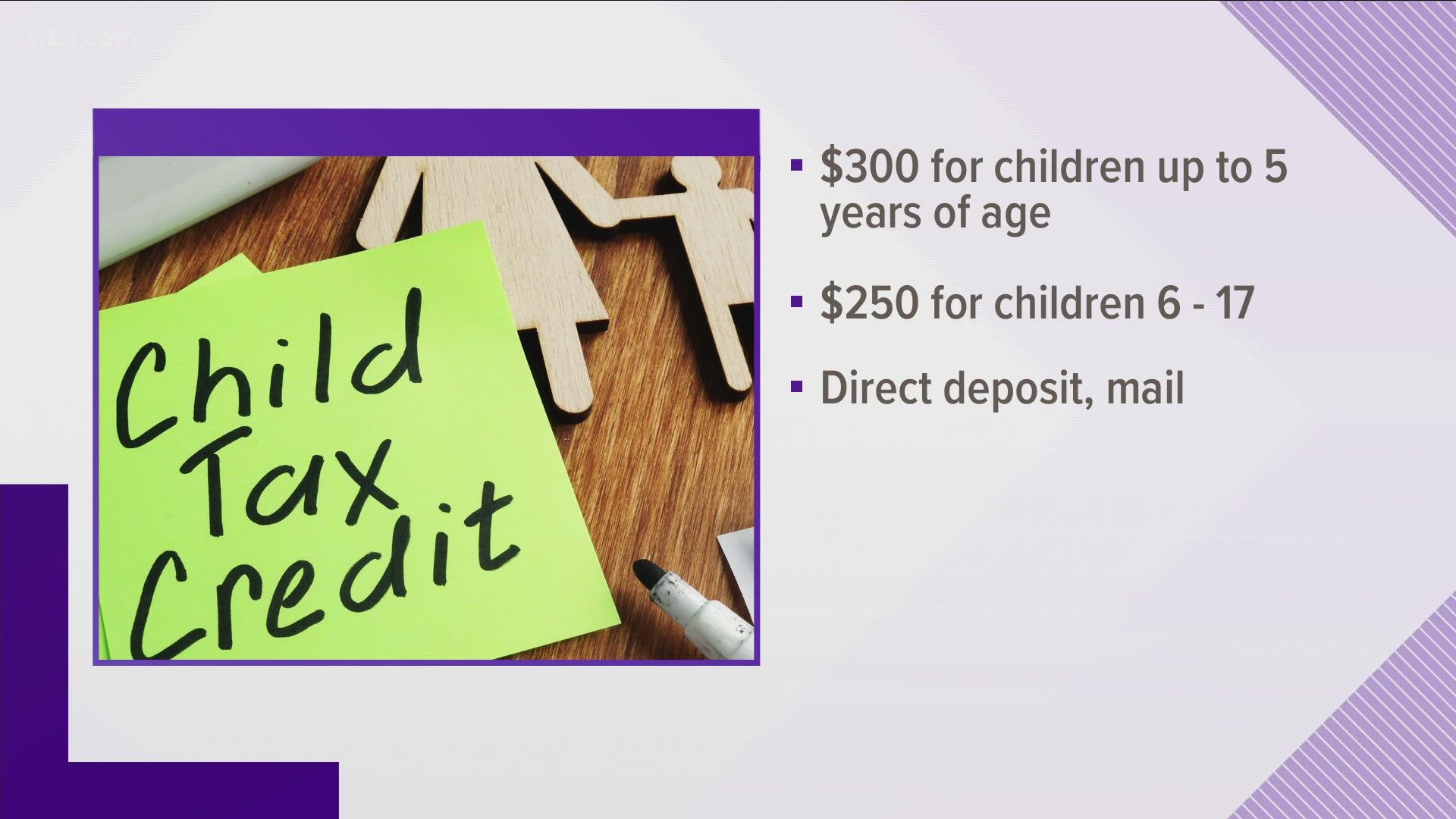

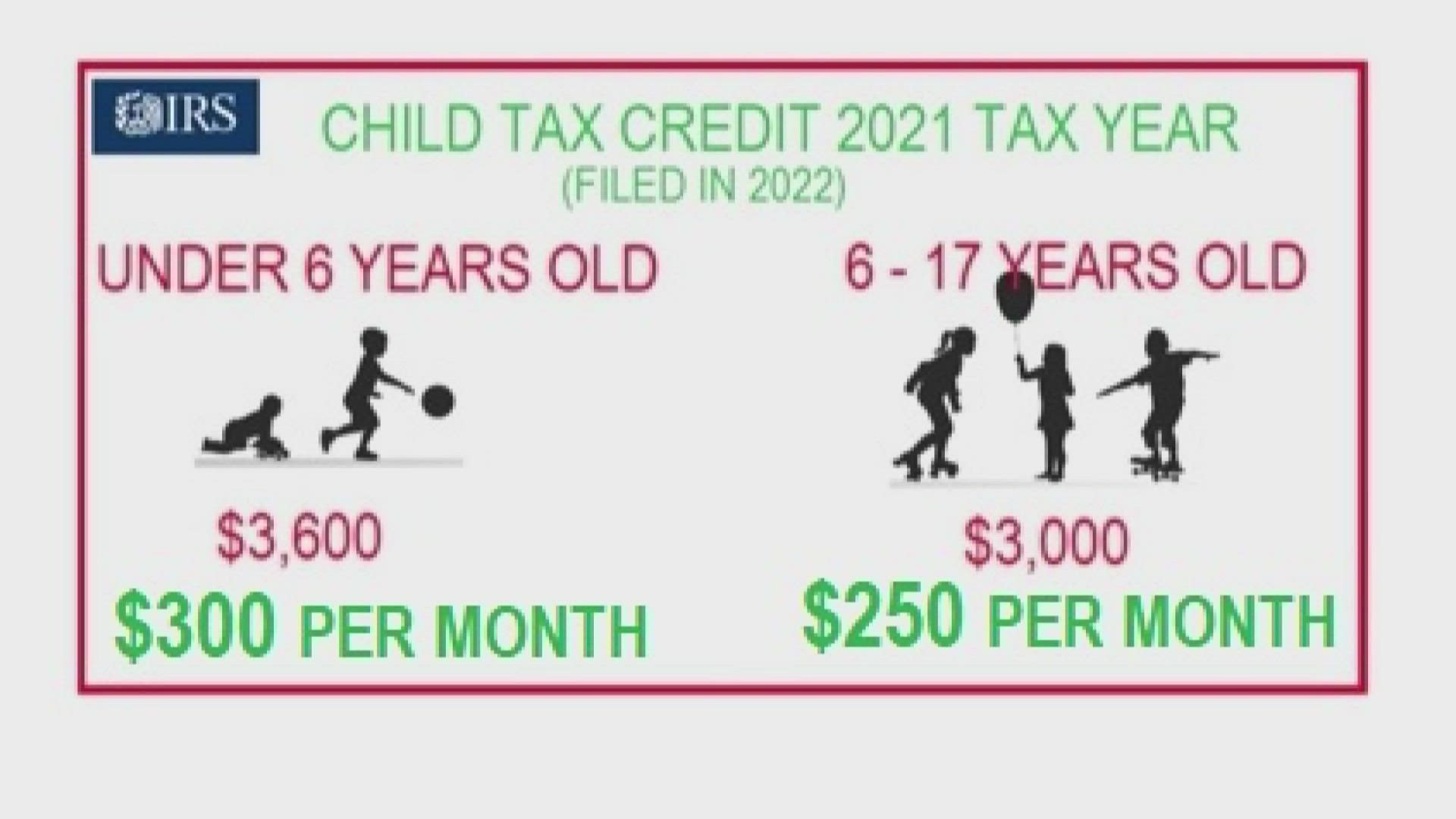

. The percentage depends on your income. 15 with each totaling up to 300 per child under age 6 and up to 250 per child ages. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

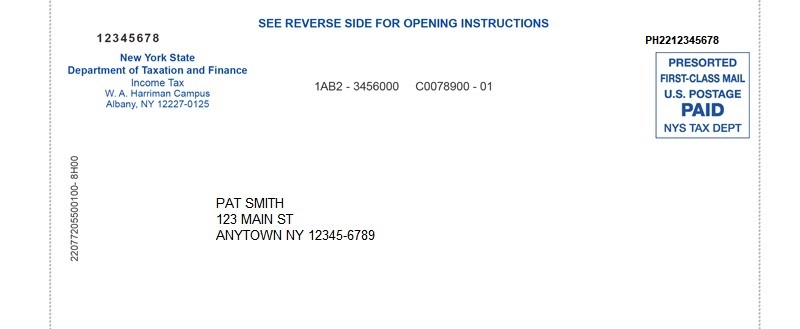

The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax. Three more child tax credit payments are scheduled for this year.

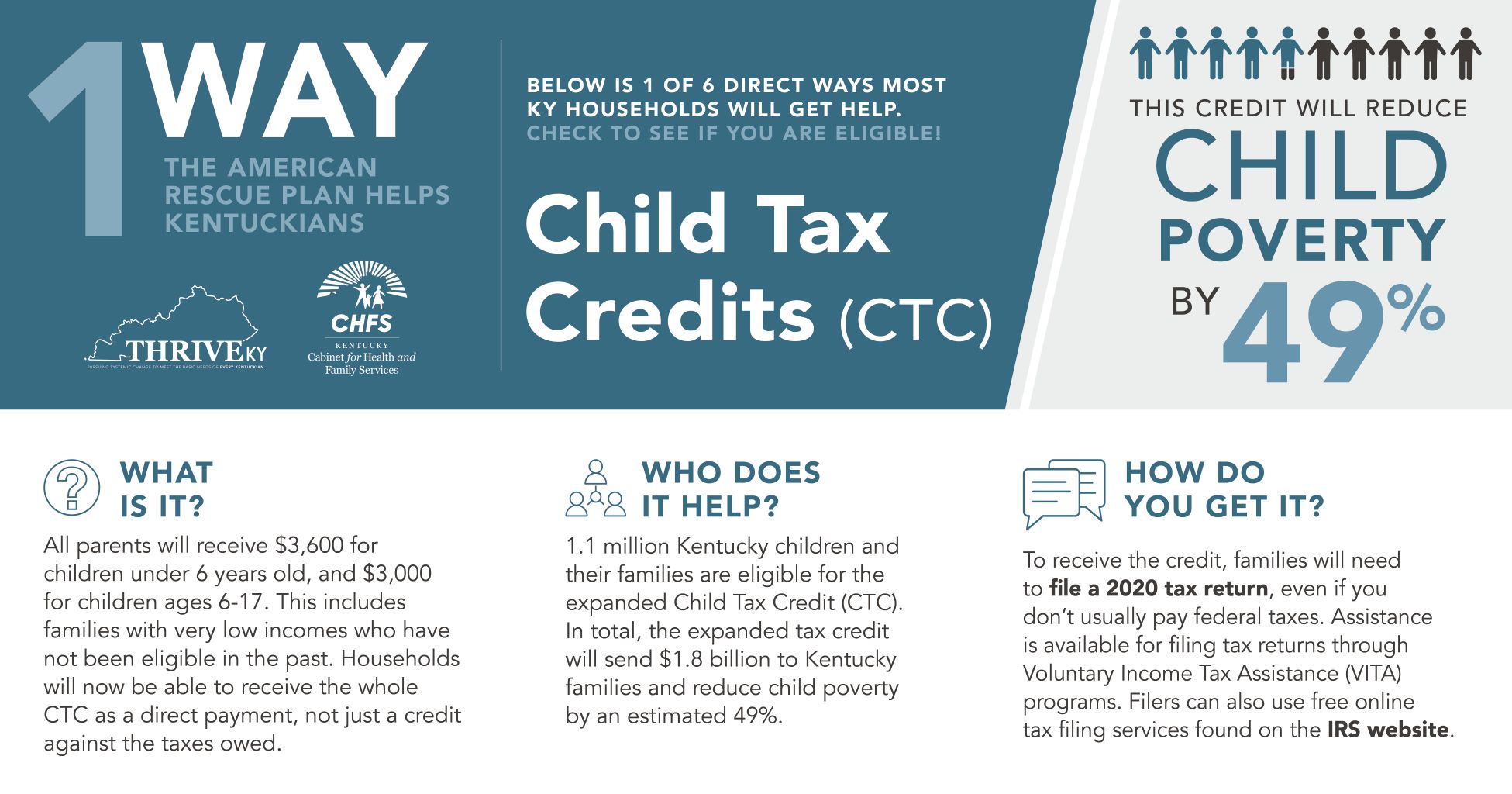

1200 in April 2020. It is worth remembering. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021.

Thats an increase from the regular child tax. Unenrollment deadline is Oct. The refundable portions of the Earned Income Tax Credit and Child Tax Credit help low- and moderate-income working families by offering cash payments to eligible.

4 at 859 pm. Three more child tax credit payments are scheduled for this year. The IRS released the following schedule of the remaining three unenrollment deadlines and payment dates.

In Rhode Island families will get 250 per child and a maximum of 750 total for up to three children with direct payments going out beginning in October. October 14 2021 559 PM CBS Detroit. For each eligible child families will get a 250 dollar payment up to a maximum of three children for a total of 750 dollars according to Daniel McKee the governor of Rhode.

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. The fourth monthly payment will go out on October 15 so you should expect to receive either 300 or 250 dollars depending on your personal situation. 15 with each totaling up to 300 per child under age 6 and up to 250 per child ages 6 through 17.

List of payment dates for Canada Child Tax Benefit CCTB GSTHST credit Universal Child Care Benefit UCCB and Working Income Tax Benefit WITB. CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow.

How The New Expanded Federal Child Tax Credit Will Work

First Monthly Child Tax Credit Payment Hits Bank Accounts Next Week

December Child Tax Credit What To Do If It Doesn T Show Up 11alive Com

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

You Got Your Last 2021 Advance Child Tax Credit Payment Now What Don T Mess With Taxes

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Woai

Additional New York State Child And Earned Income Tax Payments

Child Tax Credit Dates Here S The Entire 2021 Schedule Money

Did Your Advance Child Tax Credit Payment End Or Change Tas

Child Tax Credit Payment Schedule For 2021 Kiplinger

Child Tax Credit 2022 Monthly Payment Still Uncertain King5 Com

What Day Does The Child Tax Credit Come Out King5 Com

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

When To Expect Next Child Tax Credit Payment And More October Tax Tips

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Irs Letter 6419 For Child Tax Credit May Have Inaccurate Information

Using The Child Tax Credit To Boost Your Banking

The Child Tax Credit Payment Schedule Is Here Here S When You Ll Get Your Money